Monthly Download | Demand Update | March 2017

The movement of consumer goods, food, and freight is the pulse of an industrial market that boasts over 1 billion square feet of industrial space. The Philadelphia industrial market is recognized as one of the largest hubs of logistical real estate in the country. The existing transportation infrastructure of eight interstate highways, eight railroad terminals, four equipment depots and two ocean ports in combination with its geographical position connects this market to the broader Northeast and Mid-Atlantic markets and ports. These factors, and others, make the Philadelphia industrial market one of the most strategic locations for many companies from various industries to establish operations.

Lee & Associates of Eastern Pennsylvania’s Core Data Set (CDS) focuses on industrial buildings that are 100,000 SF or larger, with a design use currently or readily adaptable to warehouse/distribution. LAEP’s CDS seeks to identify the supply of properties within our market that meet current/modern requirements for space that will store, ship, and distribute those consumer goods, food, and freight working their way into or through the market onto their final destination. A requirement may or may not result in a sale or lease transaction, and may be focused on multiple submarkets. As these prospective tenants survey the market for their logistical solutions, LAEP diligently evaluates these requirements to remove duplicate and stagnant items over the course of each quarter. LAEP seeks to keep its finger on the pulse of our market by tracking these requirements, as we learn of them, via our Industrial Demand report.

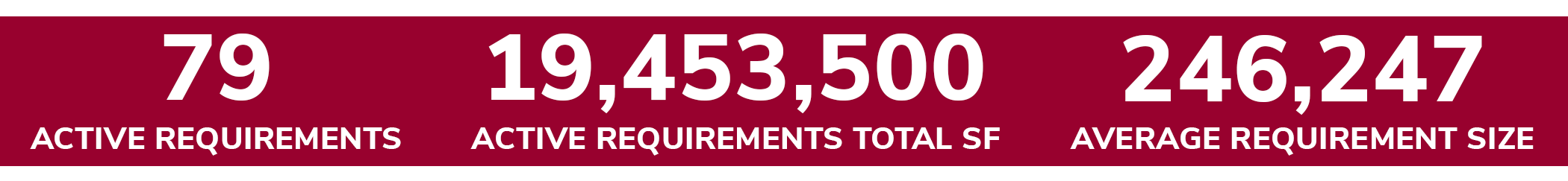

In Q1 2017, there were roughly 80 active requirements for industrial space across the entire Philadelphia market. These requirements represent a total demand of nearly 20 million square feet of needed industrial space. Of these 80 requirements, roughly a third had some sense of timing as to when the requirement would need to be met, with a significant majority (73%) requiring space before the end of 2017. Not every requirement specifies a needed or desired square footage, and in some cases, requirements may only seek acreage for development. Of the 80 active requirements, 90% specified some desired amount of rentable square footage.

The average requirement size across the market is approximately 240,000 square feet, but the average requirement size may vary drastically from submarket to submarket. In Central PA the average requirement size is 380,000 SF, while the Lehigh Valley is 230,000 SF. The average requirement size in the I-81 Corridor and Southern New Jersey are 190,000 and 80,000 respectively. 33 requirements are between 100,000 and 500,000 SF, while 12 are 500,000 SF and above. Those 12 requirements are concentrated in Central PA and the Lehigh Valley.

Similar to industrial supply activity, Central PA and the Lehigh Valley are driving demand with over 14 million and 8 million square feet of active requirements respectively, followed by Southern New Jersey and the I-81 Corridor. As mentioned, a number of requirements are considering multiple markets, as is the case when looking at the demand in the Lehigh Valley, where 61% of the demand in the Lehigh Valley is also looking in Central PA. All the requirements surveying the I-81 Corridor are also looking in the Lehigh Valley, while 40% of the total space required in Southern New Jersey is also looking at Central PA and or Lehigh Valley.

As these prospective tenants and occupiers continue to survey the Philadelphia industrial market to solve their logistical needs; LAEP has noted almost 3 million square feet of requirements have been met via a new lease and/or renewal in Q1 2017.

__

Any questions regarding the Eastern Pennsylvania market please contact us at 717.695.3840 or 610.400.0499.