Q1 2022 Philadelphia Region Industrial Market Report

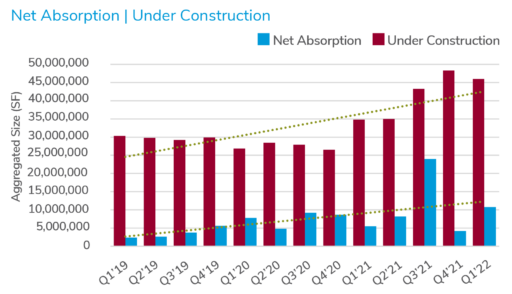

The Philadelphia Regional Industrial Market booked 10.8 MSF of net absorption for Q1’22, more than twice the level recorded in Q4’21. The surge in leasing activity offset 9.2 MSF in new construction deliveries and had the effect of reducing marketwide vacancy to a new record low level of 1.96%.

Active construction fell slightly to 46.7 MSF as a number of project starts were pushed back due to supply chain issues delaying the delivery of building materials. More than half of the construction projects are expected to deliver in the next two quarters.

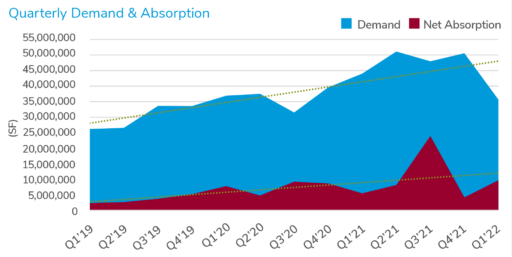

Demand weighed in at its lowest level since Q3’20, in part believed to be a reflection of reduced availability levels across the market.

Looking forward to the rest of 2022, expect net absorption increases to coincide with new construction deliver¬ies, or potentially lag by a quarter. Overall vacancy rates should hover around their current levels, or even rise slightly through Q3’22 in the wake of new speculative deliveries. If there is an increase in vacancy it is likely to be short-lived, given what we

anticipate will be a declining level of construction activity on the near horizon. As a result of the supply shortage and rising project costs, rental rates are expected to maintain a strong upward trend across the board.

Q1 2022 Industrial Market Report Download