TENANT DEMAND MIXED; AIRPORT, WEST COUNTY SHOW GAINS

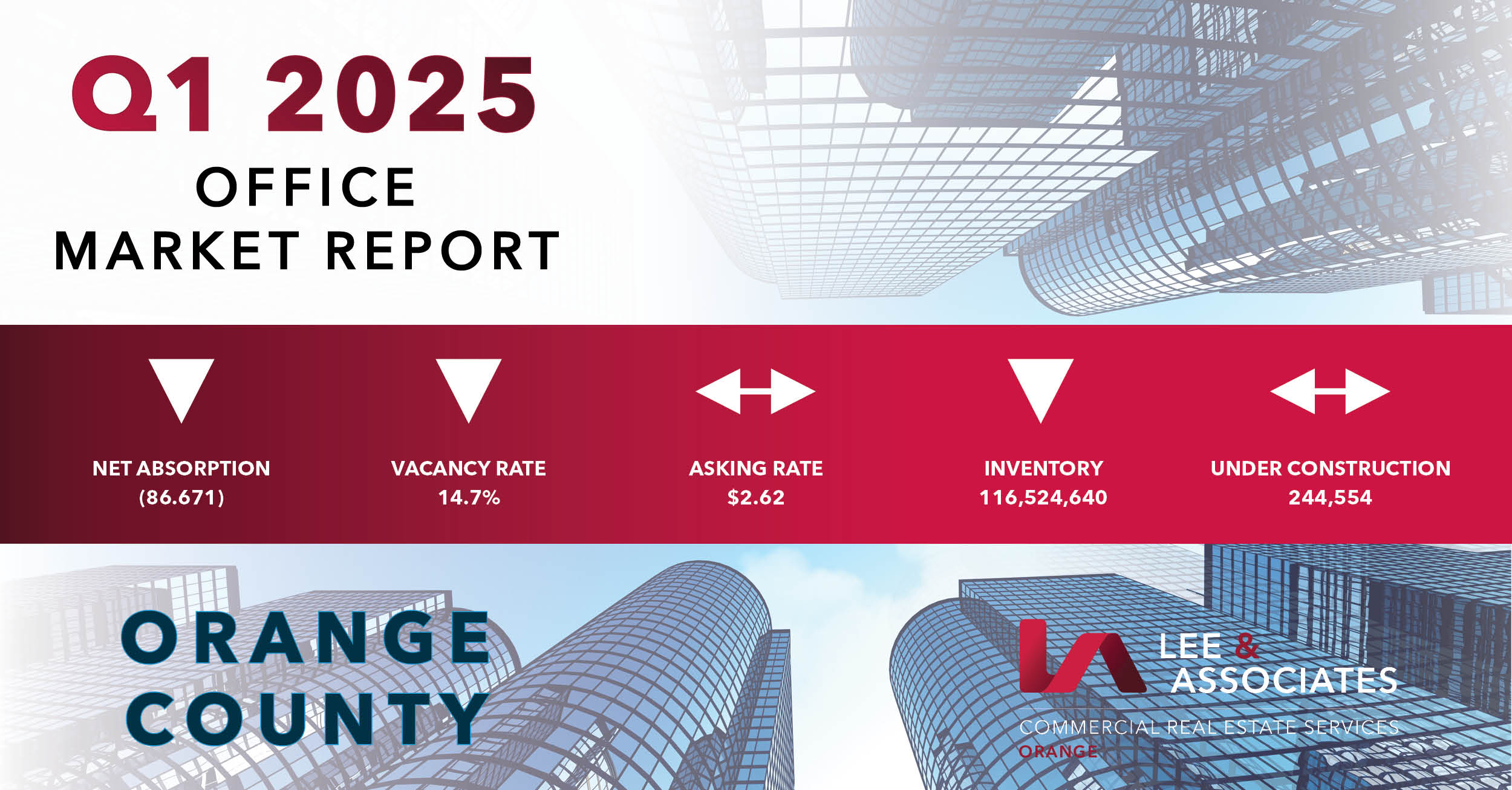

2025 Q1 OFFICE REPORT ORANGE COUNTY shows demand for office space was mixed in the first quarter as the strong market momentum that closed out 2024 failed to carry over early into the new year. Countywide net absorption in Q1 was negative 86,671 SF on tenant contraction in three of the county’s five submarkets that total 117 million SF. The weakness pushed up the overall vacancy rate slightly to 14.68%. The vacancy rate in Class A buildings was 19.1%.

A strong first-quarter performance could have been expected following the 401,893 SF of tenant expansion in Q4 and last year’s gain of 1.2 million SF of positive net absorption, the most since 2015. It also was a major reversal from the negative 1.6 million SF in 2023, the biggest annual loss since the Covid lockdown in March 2020.

Orange County’s office market had been stabilizing. Generally, fewer office tenants are relinquishing space upon lease expiration or ahead of it compared to recent years. Availability has declined, in part, due to second-hand space being leased, de-listed or expired. Sublease space absorbed in 2024 totaled 437,065 SF, the most on record in a single year.

Tenants have demonstrated a preference for new, amenity-rich creative office buildings. Developments completed within the past three years have gained nearly 2.5 million SF in tenant occupancy in the post-pandemic era. Buildings more than 25 years old lost nearly 5 million SF in occupancy.

There was 215,642 SF of negative net absorption in North County. It was the largest one-quarter decline on record for the 14-million-SF submarket that includes Anaheim, Fullerton, Brea, La Habra, Yorba Linda and Buena Park. Tenants shed 56,669 SF in the 22-million-SF Central County submarket and 48,245 SF in 8.7-million-SF West County office projects.

South County posted the greatest tenant expansion in Q1 with 123,766 SF of positive absorption, a turnaround from the negative 80,136 SF of net absorption in Q4 last year.

There was 110,119 SF of first-quarter tenant growth in the Airport submarket, the county’s largest with 44.3 million SF.

The largest lease of the quarter was the Irvine Company’s agreement with Inari Medical for two floors totaling 54,406-SF at 510 Technology Drive in the Irvine Spectrum. Asking rent was $2.95 per SF.

Safran Cabin, a maker of aircraft parts, signed a 10-year lease for 38l,202 SF of office space at 1620 Sunflower Ave., Costa Mesa.

Honeywell leased 28,606 SF at 2955 Red Hill Ave., Costa Mesa. New York Life Real Estate Investors sold an 11-story office tower in Irvine for $37 million to Greenlaw Partners in Irvine. The deal, which translates into $160.17 per SF, represented a 55% cut from the property’s acquisition price in 2015.

MARKET FORECAST

2025 Q1 OFFICE REPORT ORANGE COUNTY shows Cal State Fullerton’s quarterly survey of Orange County business leaders’ economic expectations produced a rating of 85.9%. The index was up from 73.1% in the fourth quarter of 2024, indicating significantly improved business sentiment early in the year and the biggest gain in three years.