Short Supply Sends Lease Rates, Prices Soaring

Strong demand and the record-low supply of available industrial space are combining to drive up lease rates at a torrid pace with second-quarter average asking rents jumping 4.5 percent over Q1. Virtually every building for lease or sale is drawing multiple offers, regardless of size.

Through the second quarter, average countywide lease rates climbed 9.5 percent year over year and are up 21 percent over the last eight quarters, according to data collected by Lee & Associates on 8,312 buildings totaling 277.8 million sq. ft.

The overall vacancy rate settled at 2.7 percent at the end of Q2, but the total of vacant space that is being actively marketed for lease was 2.1 percent or 5.6 million sq. ft.

The county’s base of buildings is in decline. In the last eight years, the industrial inventory has been reduced by 93 buildings totaling 4.8 million sq. ft. to make way for new multifamily or retail development. There was an 181,069-sq.-ft. building completed in Fullerton in Q2 but the countywide inventory nevertheless fell by 395,788 sq. ft. from the first quarter.

The strained market conditions have business owners weighing new strategies and options to accommodate their company’s growth and, in some cases, are re-evaluating retirement plans. For example, current building prices in record territory and concern that Congress will end the 1031 exchange in the planned tax code overhaul could be added to a list of inducements.

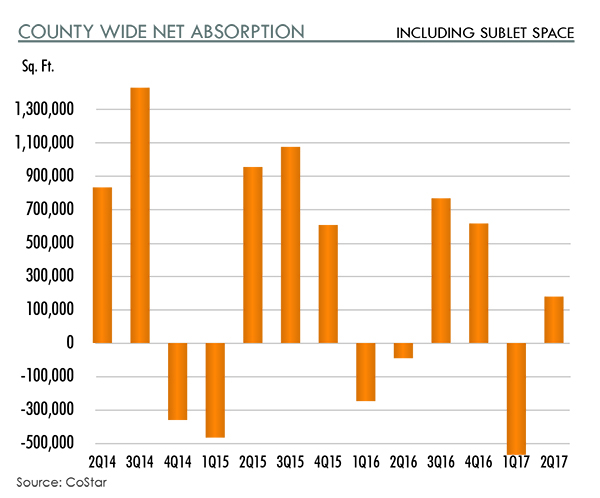

The South County submarket was the big gainer in Q2 with 407,006 sq. ft. of net absorption, pushing down the vacancy rate 100 basis points to 2.7 percent in the 41,924,704-sq.-ft. submarket.

There was 325,337 sq. ft. of negative net absorption in the West County submarket, which totals 44,717,187 sq. ft. Average asking rents in Q2 jumped 6.9 percent over Q1.

North County posted 58,315 sq. ft. of net absorption in Q2 but the vacancy rate remained unchanged at 2.3 percent. The largest submarket with 117,181,593 sq. ft. and 42 percent of the total base inventory, North County currently has only nine buildings available over 150,000 sq. ft.

Despite 22,346 sq. ft. of negative net absorption in Q2, the vacancy rate in the Airport submarket slipped 50 basis points after two buildings totaling 430,640 sq. ft. were removed from the total inventory. The Airport submarket’s base now totals 73,741,760 sq. ft.

Full Report Available 2Q 2017 Orange County Industrial Market Report

The Orange County Office Market Report is published quarterly by the Lee & Associates’ Irvine, Newport Beach and Orange offices. ©2017 Lee & Associates, Inc.