OC Office Market Remains Healthy But Rent Growth Cools

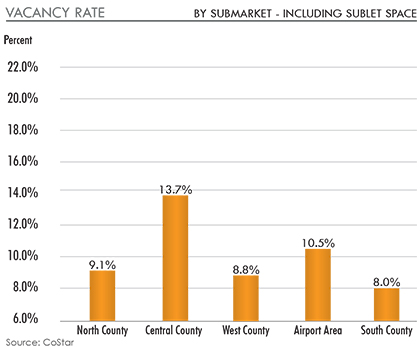

Orange County office demand in 2016 generally remained healthy despite weakened rent growth. The year-end vacancy rate settled at 10.3%.

The most activity was in the South County submarket, which saw 649,457 sq. ft. of space come off the market in 2016 along with the completion of four buildings totaling 575,000 sq. ft.

In the large Airport submarket, which accounts for 38% of the county’s inventory and much of the county’s Class A space, annual net absorption was negative for the first time since 2010.

Demand was strongest for Class B space – which accounts for roughly half of the county’s total 111.3-million-sq.-ft inventory. That kept net absorption in the overall office market from nearly slipping into the red for the year. Class B space posted a gain of 799,003 sq. ft. for 2016 with positive absorption in all four quarters.

Growth in average asking direct lease rates also slowed in 2016, increasing 3.7% for the year compared to 7.3% in 2015. Gains in direct asking rates on Class A space averaged 6.6% in 2016 versus 7.5% in 2015. For Class B space, increases in asking lease rates averaged 2.8% in 2016 compared to 5.8% in 2015.

Among the county’s cities with the largest inventories of office buildings – Irvine, Newport Beach, Santa Ana, Anaheim and Costa Mesa – there was 710,932 sq. ft. of positive absorption. The five cities combine for about 65% of the county’s total space.

The 34.1-million-sq.-ft. Irvine office market, which includes 387 of the county’s 1,309 buildings and about 31% of the county’s total space, reported 158,193 sq. ft. of net absorption in 2016. Irvine ended 2016 with an 8.8% vacancy rate, which was up a full percentage point from 2015 because 754,736 sq. ft. of new space was added to the market in the last 12 months. Average asking rents climbed 4% year over year.

Newport Beach, which includes most of the county’s premium buildings in its 9.4-million square foot inventory, posted a year-end vacancy rate of 8.4%, down from 10.27% at the end of 2015. Asking rents jumped an average of nearly 17% year over year.

In Santa Ana, with 14.2 million sq. ft. in 159 buildings, the year-end vacancy rate fell from 17.5% at the end of 2015 to 15.3% in 2016 on 147,968 sq. ft. of positive absorption.

Anaheim’s vacancy rate fell from 13.5% in 2015 to 10.3% on 102,579 sq. ft. of positive absorption and average asking rents increased 3.9%.

Costa Mesa’s vacancy rate ended the year at 12.7% on 139,068 sq. ft. of positive absorption but average rents declined 1.6%.

Full Report Available 4Q 2016 Office Report OC

The Orange County Office Market Report is published quarterly by the Lee & Associates’ Irvine, Newport Beach and Orange offices. ©2017 Lee & Associates, Inc.