Lee & Associates Q1 Report: South Florida’s Retail Sector Continues to Outperform National Average, Multifamily Market Softens

South Florida’s Q1 Market Report Shows Region’s Retail Sector Continues to Outperform National Average, Multifamily Market Softens

Local industrial and office sectors record relatively flat vacancies year-over-year, but demand remains strong...

MIAMI, FL (April 27, 2023) – South Florida maintained its status as a national retail sector standout in the first quarter of 2023, according to Lee & Associates South Florida’s Q1 2023 market report. The region’s multifamily market continues to soften, however, with vacancies creeping up in the tri-county area.

Retail

Retail vacancies declined from 3.5% in the first quarter of 2022 to 3.1% in the first quarter of 2023. The national average vacancy rate was 4.2% at the end of the quarter. Average asking rents jumped year-over-year from $32.53 per square foot NNN to $35.97.

More than 4.5 million square feet of retail construction is in the pipeline and could potentially impact the razor-thin vacancy rate going forward.

"South Florida’s Retail market continues to fare better than many other parts of the country, with vacancy rates holding steady at 3.1% across the three counties compared to a 4.2% nationwide average. Rental rates remain on the rise with average rents increasing in Miami-Dade County to $43.31 PSF, Broward County to $33.46 PSF, and Palm Beach County to $33.59 PSF. Across the tri-county region, market cap rates have dropped to 5.5% and the average sale price has increased to $375 PSF, though sales volume has been showing a decline over the last four consecutive quarters. New construction continues to deliver, bringing over 363,500 SF of new inventory in Q1 with over 4.5 Million SF currently underway."

Industrial

The tri-county area of South Florida closed the first quarter of 2023 with a 2.3% industrial vacancy rate, down from 2.8% a year earlier but flat when compared with the fourth quarter of 2022. The average asking rent surged year-over-year from $12.01 per square foot triple-net (NNN) to $15.40.

Lee & Associates South Florida Principal Greg Milopoulos notes that industrial lease rates “have started to stabilize,” with landlords more willing to provide enhanced tenant improvement allowances for credit tenants.

“We all hear the hysteria and uncertainty in the U.S. markets, but Southeast Florida still appears to be somewhat isolated with the continued ‘flight to business freedom’ that our state allows for,” Milopoulos said.

“Lease rates have started to stabilize with Landlords willing to bend on lease term and necessary TI allowances. I think credit will be the most important thing landlords look for going into 2023 with the willingness to come off their marketed lease rates and term in return for strong credit tenants. We all hear the hysteria and uncertainty in the US markets but S. East Florida still appears to be somewhat isolated with the continued “flight to business freedom” that our state allows for. On the acquisitions side, institutional buyers continue to ride the emotional wave that the media portrays with the cost of debt being their voice of reason, but property owners aren’t really caving or trending in the same direction as many of them aren’t over leverage and those that do have debt, have rates below 4.5%. At this point underwriting seems to be picking back up again and I don’t feel real estate valuations will follow assuming lease rates maintain at $14.50 NNN average."

Office

South Florida’s office sector had a slight year-over-year drop in vacancies in the first quarter, from 9% to 8.6%. Average asking rents rose from $33.99 per square foot NNN in the first quarter of 2022 to $36.36.

“Although we are not seeing New York City and California rates, we are inching closer,” Lee & Associates South Florida Principal Elias Porras said.

“Palm Beach and Miami’s Brickell and Downtown continue to provide office market momentum in 2023. In Miami, 801 Brickell’s asking rates range from $90 - $110 PSF, FS, and Palm Beach 230 Royal Palm Way’s asking rates are $100 NNN PSF + $29.62 OE. Vacancy rates continue to decline in both Counties, and average rents in the entire Tri-County region have continued to rise. Although we are not seeing New York City and California rates, we are inching closer. Miami-Dade averages $50.04 PSF FS up from $45.26 PSF FS in Q1 of 2022, Broward averages $37.33 PSF FS up from $36.89 PSF FS, and Palm Beach averages $39.78 PSF FS up from $38.69 PSF FS."

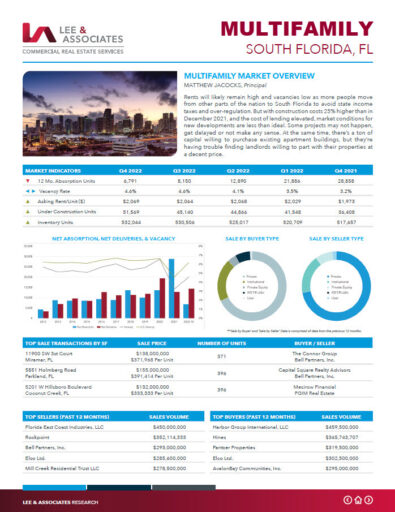

Multifamily

The local multifamily sector saw a notable year-over-year increase in vacancies in the first quarter of 2023, from 3.5% to 4.8%. Asking rents rose $2,039/month to $2,097/month. It is worth noting that rents barely increased from the fourth quarter of 2022 ($2,081/month).

Tight single-family residential supply will force some would-be buyers to rent and help the region avoid substantial vacancy increases or rent declines, according to Lee & Associates South Florida Senior Vice President Andy Hidalgo.

“Living preferences are shifting towards a society more inclined to rent,” Hidalgo said. “The scarcity of Class C apartments has intensified the demand for lower-tier rentals, particularly in the more reasonable priced neighborhoods in South Florida.”

“Though not impervious to broad economic difficulties, the substantial influx of people moving to Florida has reduced available single-family homes in most areas, making apartments a relatively more budget-friendly option. As a result, living preferences are shifting towards a society more inclined to rent, taking advantage of the cost savings, adaptability, and lifestyle benefits. The scarcity of Class C apartments has intensified the demand for lower-tier rentals, particularly in the more reasonably priced neighborhoods in South Florida. Florida’s recently enacted affordable housing legislation, the Live Local Act, through local government incentives and low-interest loans, is anticipated to incentivize developers and those considering mixed-use projects to create additional housing."

South Florida Q1 Market Reports

About Lee & Associates | South Florida

Lee & Associates | South Florida is a fully vertical commercial real estate brokerage firm focused on industrial, office, retail, multifamily, investment and land sectors. Our dedicated team of professionals is led by Matthew Rotolante, CCIM, SIOR a 4th generation South Florida native in a family that has owned and operated commercial property here since 1928. Lee & Associates is the largest agent owned brokerage in the nation with Senior Agent’s ability to earn profit share resulting in the highest splits while still receiving full resources, support and leads from our national network. Our collaborative and cheerful culture allows for open communications throughout the company, fostering the sharing of information and best practices to better enable client decision making. The Lee & Associates’ robust national network that sold and leased over $32 Billion in 2022 offers clients a cross-market platform of expertise and deal opportunities across all asset specialties and representation roles. For the latest news from Lee & Associates South Florida, visit leesouthflorida.com or follow us on Facebook, LinkedIn, Twitter and Instagram, our company local news.

Lee & Associates is a commercial real estate brokerage sales, leasing and management firm. Established in 1979, Lee & Associates has grown its service platform to include over 75 offices in the United States and Canada. Lee & Associates is the largest agent owned commercial real estate brokerage where agents get the greatest return for their efforts and hence are more committed and better enabled to provide superior results for their customers. For the latest news from Lee & Associates, visit lee-associates.com or follow us on Facebook, LinkedIn, Twitter and Link, our company blog.