Lee & Associates South Florida Q1 Report: Vacancies Stabilize in Key Real Estate Sectors

Lee & Associates South Florida Q1 Report: Vacancies Stabilize in Key Real Estate Sectors

Local retail, office, multifamily and industrial markets continue to outperform national averages...

MIAMI, FL (April 23, 2024) – South Florida’s commercial real estate market keeps outpacing the rest of the nation, even as the region is further removed from the pandemic-era frenzy of activity, according to Lee & Associates South Florida’s Q1 2024 market report. Vacancies stabilized in the local multifamily, office and retail sectors, while the industrial vacancy rate notably jumped year-over-year.

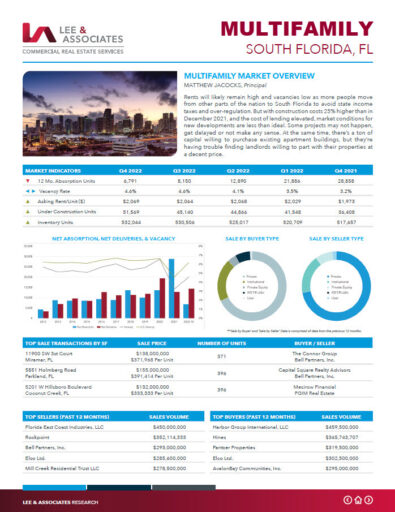

Multifamily

South Florida’s multifamily sector recorded a year-over-year rise in vacancies in the first quarter of 2024, from 5.0% to 5.6%. However, the 5.6% vacancy rate stayed flat when compared with the previous quarter. Asking rents inched up year-over-year from $2,132/month to $2,159/month.

"Multifamily investment in South Florida outpaces most other asset classes locally, and the multifamily sector nationally as we enter the second quarter of 2024. Net absorption is approaching equilibrium with net deliveries in the sector, which seems healthier than the prior two years,” Lee & Associates Principal Todd Cohen said. “Furthermore, vacancy rates seem to have stabilized in the mid 5 percent range. Rental rates and growth remain strong, sales numbers are robust, and demand for rentals will not be satiated while costs to purchase new homes continue to prove untenable for most buyers, especially first time buyers to be. Additional affordable housing is needed more than ever in South Florida, and there is a push by municipalities and developers alike to meet that skyrocketing demand

Office

South Florida’s office vacancies declined slightly year-over-year in the first quarter, from 8.3% to 8.2%. The average asking rent jumped from $36.01 per square foot NNN to $37.02 in the same span.

South Florida’s office vacancies declined slightly year-over-year in the first quarter, from 8.3% to 8.2%. The average asking rent jumped from $36.01 per square foot NNN to $37.02 in the same span.

“The South Florida office market continues to outperform the national office market trends with Landlords in several key submarkets like Brickell, Coconut Grove, Miami Beach, Coral Gables, and Boca Raton holding strong to record rates,” Lee & Associates South Florida Principal Bert Checa said. “Overall vacancy rates across the tri-county region have seemed to stabilize at a consistent rate over the last four quarters, while new construction projects persist with over 5 million square feet still underway. That being said, the amount of sublease space in the Class A and Class B office buildings continues to increase in Miami’s Central Business District.

Retail

Retail vacancies remained flat year-over-year at 3.0% in the first quarter. Average asking rents declined year-over-year from $36.03 per square foot NNN to $35.89.

“The South Florida retail market showcased promising trends and big name tenants in Q1 2024 despite limited availability of existing space. With over 2.3m sf of space still under construction in 2024 the market remains at a tight 3.0% vacancy rate due to a limited supply of inventory. General retail and grocery-anchored neighborhood centers, which make up the largest share of retail inventory in the market continue to see healthy leasing activity as consumer spending on services and essentials continues despite persistent inflation and elevated interest rates,” Lee & Associates South Florida Principal Stephen DeMeo said. “When looking specifically at deal sizes, the bulk of new lease activity continues to occur within spaces of between 1,000 and 5,000 SF, which make up over 60% of lease transactions. While NNN asking rents have dipped slightly to $35.89/sf in Q1, the largest leases over the past quarter have been signed by BJ’s Wholesale Club, Floor & Décor and Macy’s. Demographic growth along with the return of tourists continues to further bolster South Florida resident and tourism spending."

Industrial

The tri-county area of South Florida closed the first quarter of 2024 with a 3.4% industrial vacancy rate, up from 2.3% a year earlier. The average asking rent surged year-over-year from $15.43 per square foot triple-net (NNN) to $17.22 per square foot.

"The South Florida Industrial asset class continues to perform as one of the market darlings while e-commerce and last mile trends combined with robust in-migration of people and capital fuels continued demand for tenants and investors alike," Lee & Associates Vice President C. Todd Everett, SIOR said. "While net absorption has slowed significantly from a year ago, so has the supply of under construction inventory which stands at 8.8MM SF, down from over 13MM SF and this should help to stabilize vacancy and absorption. Meanwhile rates continue to rise and outpace the National average albeit at a slower pace. On the investment front cap rates remain compressed relative to other asset classes that have seen a sharper rise, while demand remains high."

.

South Florida Q1 Market Reports

About Lee & Associates | South Florida

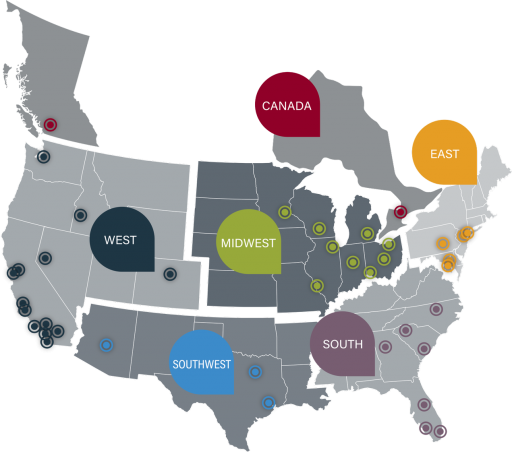

Lee & Associates | South Florida is a fully vertical commercial real estate brokerage firm focused on industrial, office, retail, multifamily, investment and land sectors. Our dedicated team of professionals is led by Matthew Rotolante, CCIM, SIOR a 4th generation South Florida native in a family that has owned and operated commercial property here since 1928. Lee & Associates is the largest agent owned brokerage in the nation with Senior Agent’s ability to earn profit share resulting in the highest splits while still receiving full resources, support and leads from our national network. Our collaborative and cheerful culture allows for open communications throughout the company, fostering the sharing of information and best practices to better enable client decision making. The Lee & Associates’ robust national network that sold and leased over $32 Billion in 2022 offers clients a cross-market platform of expertise and deal opportunities across all asset specialties and representation roles. For the latest news from Lee & Associates South Florida, visit leesouthflorida.com or follow us on Facebook, LinkedIn, Twitter and Instagram, our company local news.

Lee & Associates is a commercial real estate brokerage sales, leasing and management firm. Established in 1979, Lee & Associates has grown its service platform to include over 75 offices in the United States and Canada. Lee & Associates is the largest agent owned commercial real estate brokerage where agents get the greatest return for their efforts and hence are more committed and better enabled to provide superior results for their customers. For the latest news from Lee & Associates, visit lee-associates.com or follow us on Facebook, LinkedIn, Twitter and Link, our company blog.