Lee & Associates South Florida Q3 Report: Office Market Demonstrates Resilience Amid National Slowdown

Lee & Associates South Florida Q3 Report: Office Market Demonstrates Resilience Amid National Slowdown

Local multifamily and industrial sectors soften in third quarter of 2024, while retail maintains strong performance...

MIAMI, FL (October 23, 2024) – South Florida’s office market is not experiencing the doom and gloom reported in other parts of the country, according to Lee & Associates South Florida’s Q3 2024 market report. The local multifamily and industrial sectors saw sharp vacancy rate increases during the third quarter of 2024, however, while the retail market continues to benefit from strong demand and tight supply.

Office

The tri-county area of South Florida closed the third quarter of 2024 with an 8.2% office vacancy rate, slightly down from 8.4% a year earlier. The average asking rent climbed year-over-year from $36.16 per square foot triple-net (NNN) to $37.58 per square foot.

The tri-county area of South Florida closed the third quarter of 2024 with an 8.2% office vacancy rate, slightly down from 8.4% a year earlier. The average asking rent climbed year-over-year from $36.16 per square foot triple-net (NNN) to $37.58 per square foot.

“South Florida is still benefiting from its reputation as an office mecca earned during the boom,” Lee & Associates South Florida Senior Vice President Matthew Katzen said. "Vacancy rates stayed steady at 8.2% where they’ve been for the last several quarters. 701 Brickell just closed for $43 Million. Acquired by Nuveen Real Estate in 2002, the building sold to hedge fund Elliott Management. Brickell is currently the top performing office market in the US in terms of occupancy and rent growth. Overall Office sales are down compared to the past several years. Average price per sf and high occupancy have remained strong despite investment sales slowing with high interest rates, Owners looking to refinance and acquire assets welcome the news of lower interest rates to come"

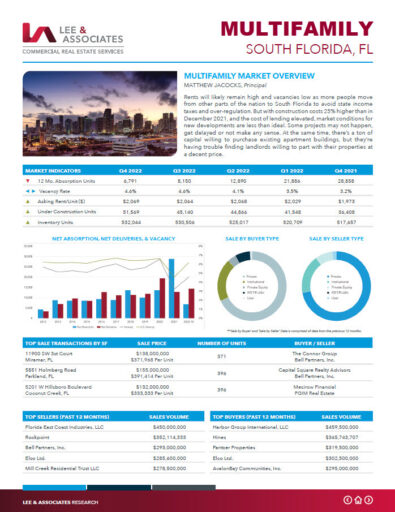

Multifamily

South Florida’s multifamily sector recorded a year-over-year rise in vacancies in Q3 of 2024, from 5.6% to 6.3%. Asking rents increased year-over-year from $2,169/month to $2,203/month.

"South Florida’s multifamily sector continues to show signs of a slowdown as we enter the final quarter of 2024, but remains strong relative to other asset classes and markets," said Lee & Associates South Florida Principal, Todd Cohen. "Net absorption has softened relative to net deliveries but still outpaces the previous two years after only three quarters, as renting remains the only viable option for most would-be homeowners. Vacancy rates are inching up slowly, but remain substantially lower than the national average. Rental growth is strong, though slightly less than previous quarters, and while sales per door are down, cap rates are lower due to recent interest rate cuts. Affordable housing is in high demand, with municipalities and developers pushing to meet this growing need."

Industrial

South Florida’s industrial vacancies jumped significantly in the third quarter, from 2.8% to 4.5%. The average asking rent climbed from $16.93 per square foot NNN to $17.18 in the same span.

"The South Florida industrial market is experiencing heightened sales activity, as reflected in the strong net absorption figures for Q3. Net absorption increased to 2.82 million sf, up from 1.56 million in Q2, signaling robust demand," said Lee & Associates South Florida Principal, Sebastian Misiewicz. "However, the leasing market is slowing, with vacancy rates climbing from 4.1% to 4.5%. This rise is likely due to an influx of new supply and slower lease activity. Rents have also plateaued, with average NNN asking rates declining slightly from $17.27 to $17.18. Despite strong sales, the leasing market is stabilizing in response to increased vacancies and new inventory. Overall, the market demonstrated positive demand growth, but rising vacancies and slight rent declines point to a more balanced market landscape."

Retail

Retail vacancies inched up year-over-year from 3.0% to 3.1% in Q3. Average asking rents also increased year-over-year, from $36.05 per square foot NNN to $37.06.

“As South Florida’s retail markets advance, rent growth will moderate as softer demand from slowing consumption meets limited inventory,” Lee & Associates South Florida Principal Stephen DeMeo said. "Despite this, the market’s attractiveness and lack of available space should drive an outperformance in values compared to the national average. Vacancies are forecast to expand slightly through the end of 2024, resulting in slower yet healthy absorption levels, maintaining historically low vacancy rates near 3%. Tenant move-outs remain below the five-year average, and with limited new supply, space availability will stay tight, well below the U.S. average. Major leases this year have been signed by home goods, entertainment, clothing, and fitness tenants, including Floor & Decor, Burlington, Crunch Fitness, Nordstrom, and Altitude Trampoline Park"

QuarterLEE South Florida Market Reports

About Lee & Associates | South Florida

Lee & Associates | South Florida is a fully vertical commercial real estate brokerage firm focused on industrial, office, retail, multifamily, investment and land sectors. Our dedicated team of professionals is led by Matthew Rotolante, CCIM, SIOR a 4th generation South Florida native in a family that has owned and operated commercial property here since 1928. Lee & Associates is the largest agent owned brokerage in the nation with Senior Agent’s ability to earn profit share resulting in the highest splits while still receiving full resources, support and leads from our national network. Our collaborative and cheerful culture allows for open communications throughout the company, fostering the sharing of information and best practices to better enable client decision making. The Lee & Associates’ robust national network that sold and leased over $115 Billion over the last 5 years offers clients a cross-market platform of expertise and deal opportunities across all asset specialties and representation roles. For the latest news from Lee & Associates South Florida, visit leesouthflorida.com or follow us on Facebook, LinkedIn, Twitter and Instagram, our company local news.

Lee & Associates is a commercial real estate brokerage sales, leasing and management firm. Established in 1979, Lee & Associates has grown its service platform to include over 75 offices in the United States and Canada. Lee & Associates is the largest agent owned commercial real estate brokerage where agents get the greatest return for their efforts and hence are more committed and better enabled to provide superior results for their customers. For the latest news from Lee & Associates, visit lee-associates.com or follow us on Facebook, LinkedIn, Twitter and Link, our company blog.